A committee of the Senate is investigating whether an eminent cryptocurrency investor has violated the federal tax law to save hundreds of millions of dollars after moving to Puerto Rico, a popular offshore tax paradise, according to a letter examined by the New York Times.

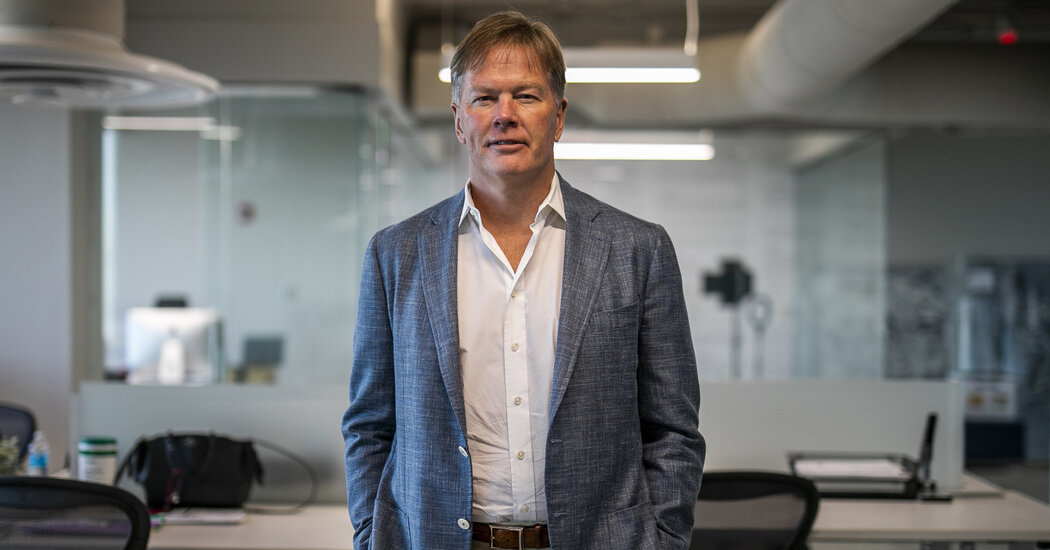

Senator Ron Wyden, a Democrat of Oregon, sent the letter on January 9 to Dan Morehead, the founder of Pantera Capital, one of the largest investment companies in cryptocurrency.

The letter stated that the Senate Financial Committee was investigating the tax conformity by rich Americans who had moved to Puerto Rico to exploit a special tax position for the island residents who can reduce tax bills to zero.

The investigation was focused on people who had improperly applied the tax interface to avoid paying taxes on income that was earned outside Puerto Rico, according to the letter.

“In most cases, most of the gain is actually an income from a US source, reportable on the tax returns of the United States and subject to the US tax,” said the letter.

The letter requested detailed information from Mr. Morehead about $ 850 million investment profits he made after moving to Puerto Rico in 2020, observing that “he may have treated earnings as exempt from US taxes.

Morehead declared in a statement that moved to Puerto Rico in 2021. “I think I acted appropriately as regards my taxes,” he said.

Wyden was president of the financial committee until the Republicans took control of the Senate last month. During his mandate, the Committee investigated on various strategies that rich Americans used to avoid paying taxes.

It is not clear what can come from the investigation. Under the Biden administration, federal regulators and democratic legislators have reduced themselves to the cryptocurrency industry and the main technological characters. President Trump and the Republicans at Congress embraced crypts, promising less aggressive application.

A Wyden spokesman said that the investigation was “in progress” and refused further comments. A spokesman for the new president of the financial committee, Senator Michael D. Crap dell’Idaho, did not respond to a request for comment.

For more than a decade, the rich Americans, including many technological entrepreneurs, gathered in Puerto Rico to exploit act 60, a tax leasing established in 2012 with a different name. Any income from capital gain generated in the US territory is not subject to local or federal income tax.

In recent years, the Department of Justice, the Internal Revenue Service and the legislators have studied the abuses of that system. Irs said that his criminal division identified about 100 people who may have committed tax evasion.

Former Goldman Sachs merchant, Morehead founded Pantera in the early 2000s and transformed him into one of the largest investment companies focused on the crypt, supporting more than 100 cryptocurrency companies in the last 12 years. These include important US cryptocurrency companies such as Circle, Ripple and Coinbase, which manages the largest market for digital currencies in the United States.

After Mr. Morehead moved to Puerto Rico, Pantera sold “a great position” and generated capital gains “over $ 1 billion”, according to Mr. Wyden’s letter. The share of Mr. Morehead’s earnings amounted to over 850 million dollars, says the letter.

The letter asked Mr. Morehead to share information relating to these transactions, including the names of his tax consultants. He also asked him to share a list of any activity he sold while residing in Puerto Rico, including cryptocurrencies.