The Trump administration took measures on Monday that seem to cause new rates on semiconductors and pharmaceutical products, adding to the samples that President Trump has made imports globally.

The federal notices put online on Monday afternoon said that the administration launched investigations on national security on the imports of chips and pharmaceutical products. Trump suggested that those investigations could cause rates.

The investigations will also cover the machinery used to create semiconductors, products that contain chips and pharmaceutical ingredients.

In a declaration that confirms the move, Kush Desai, a spokesman for the White House, said that the president “has long been clear about the importance of the reduction of production which is fundamental for the national and economic security of our country”.

The new rates for semiconductors and pharmaceuticals would be issued pursuant to section 232 of the 1962 trade Expansion Act, which allows the president to impose rates to protect the United States national security.

At the beginning of the day, Trump hinted that he would soon import new rates on semiconductors and pharmaceutical products, while trying to support greater internal production.

“The higher the rate, faster they enter,” Trump said to journalists in an appearance of the White House, citing taxes on imports he has imposed in steel, aluminum and cars.

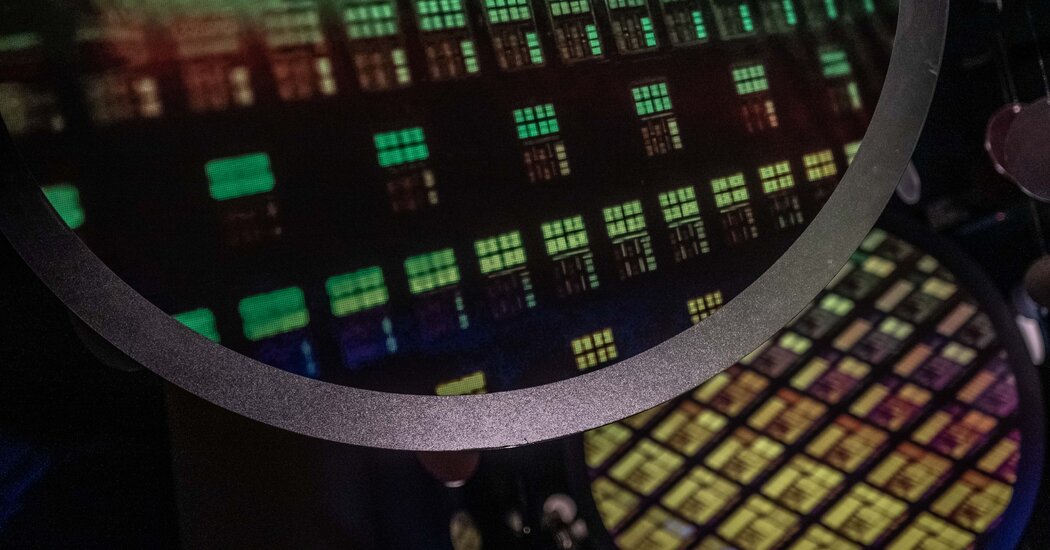

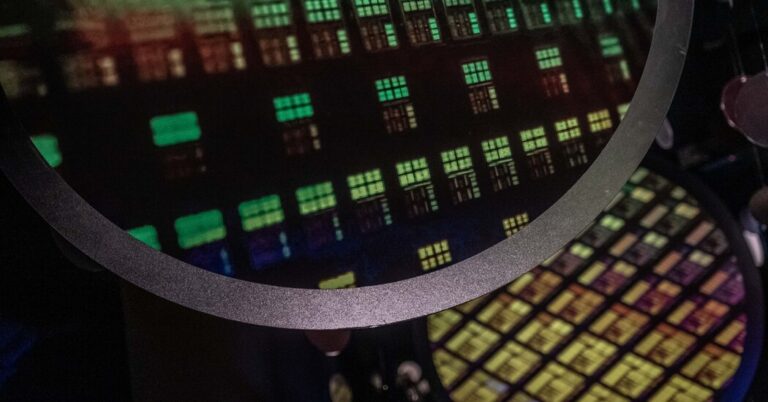

Semiconductors are used to feed electronics, cars, toys and other goods. The United States depend strongly on the chips imported from Taiwan and elsewhere in Asia, an addiction that Democrats and Republicans have described as a serious risk to national security.

As for pharmaceutical products, Trump claimed that too many vital medicines have been imported. “We don’t do our drugs anymore,” he said.

Some drugs are produced at least in part in the United States, although China, Ireland and India are significant sources of some types of pharmaceutical products.

Trump also reported on Monday that he could have offered some relief companies from his rates, as has done for electronic imports in the last few days – a break from his past insistence that would not have spared entire industries.

The president said he was “looking at something to help some car companies, where they are going to parts that have been made in Canada, Mexico and other places”. He added: “And they need some time because they have to do them here.” The actions of General Motors, Ford Motor and Stellantide jumped after his comments.

“I am a very flexible person. I don’t change my mind, but I’m flexible,” Trump said on Monday when he was asked for possible exemptions. He added that he spoke with the CEO of Apple, Tim Cook, and to have “helped” him recently.

The president has announced significant changes in the last week to his commercial program, which has broken the markets and has frightened the companies he is trying to persuade to invest in the United States.

Trump has announced a “mutual” global rates program on April 2, including high samples on the countries that produce many electronics, such as Vietnam. But after the turbulence in the bond market, he paused those global rates for 90 days so that his government could carry out commercial negotiations with other countries.

Those tax taxes have arrived in addition to other rates that Trump has put on a variety of sectors and countries, including a 10 % rate on all US imports; a 25 % rate on steel, aluminum and car; and a 25 % rate on many goods from Canada and Mexico. Overall, the moves have increased the US rates at levels not observed in over a century.

In the midst of a spit with China, Mr. Trump collected rates on Chinese imports last week with a minimum of 145 percent, before exempting smartphones, laptops, TVs and other electronics on Friday. Those goods represent about a quarter of the US imports from China.

The administration argued that the move was simply a “clarification”, stating that those electronics would be included in the context of the national security survey on chips.

But the managers of the sector and analysts have wondered if the true motivation of the administration may have been to avoid a repercussions linked to a strong increase in prices for many consumption electronics or to help technological companies, such as Apple, who have reached the White House in the last few days to argue that the rates would damage them.

Trump has already used legal authority pursuant to section 232 to issue rates on steel, aluminum and imported cars. The administration is also using the authority to carry out investigations on the imports of timber and copper.

On Monday, the notices reported that the Administration began his investigations on the imports of pharmaceutical products and semiconductors on April 1st. Neither the White House nor did the President previously said that the process had officially started.

Kevin Hassett, director of the National Economic Council of the White House, told journalists on Monday that chip rates were necessary for national security.

“The example I like to use is, if you have a cannon but you are getting the cannon balls from an opponent, so if there was a sort of action, then you could finish the cannon balls,” he said. “And so you can put a rate on the cannon balls.”

Trump has argued that the rates on the chips will force the companies to transfer their factories to the United States.

Some technological companies have responded to the requests of the president to build more in the United States. The Taiwan Semiconductor Manufacturing Company, the largest chip producer in the world, announced to the White House in March that would have spent $ 100 billion in the United States in the next four years to expand its production capacity.

Apple has announced that it will spend $ 500 billion in the United States in the next four years to expand structures across the country.

On Monday, Nvidia, the chipmaker, announced that he would produce supercomputer for artificial intelligence made entirely in the United States. In the next four years, the company said, it will produce up to $ 500 billion in artificial intelligence infrastructure in the United States in collaboration with TSMC and other companies.

“The AI infrastructure engines are under construction in the United States for the first time,” said Jensen Huang, CEO of Nvidia, in a note.

The White House has expelled the news in an announcement that accredited the president.

“It is the effect of Trump in action”, says the declaration, adding, “Oshoring of these industries is good for the American worker, good for the American economy and good for American national security – and the best still has to come”.

But some critics have questioned how much tariffs will really help strengthen the United States industry, given that the Trump administration is also threatening to withdraw the subsidies granted to chip factories by the Biden administration. And foreign governments such as China, Japan, South Korea and Taiwan greatly subsidize the production of semiconductors with tools such as subsidies and tax breaks.

On a global level, 105 new chip factories, or fab, will be available until 2028, according to data compiled by seeds, an association of suppliers of global semiconductor. Fifteen of these are scheduled for the United States, while most of them are in Asia.

Trump criticized the Chips Act, a $ 50 billion program set up under the Biden administration and aimed at offering incentives for the production of chips in the United States. He defined the subsidies a waste of money and insisted that only the rates are sufficient to encourage the production of internal chips.

Jimmy Goodrich, senior consultant of the Rand Corporation for technological analysis, said that the rates could be effective “if used intelligently, as part of a wider strategy to revitalize the American chip that includes domestic production and purchase of preferential chips preferential tax credits, together with intelligent ways to limit the next tsunami of the Chinese excess chip”.

“However,” he added, “the United States only represent about a quarter of any global question of goods with chips, so working with allied nations is fundamental”.

Administration officials suggested that chip rates could be applied to semiconductors that enter the United States within other devices. Most chips are not imported directly, rather, are assembled in electronics, toys and car parts in Asia or Mexico before being sent to the United States.

The United States do not have a system to apply the rates to the chips enclosed within other products, but the United States commercial representative office started examining this question during the Biden administration. Chip industry managers say that such a system would be difficult to establish, but possible.

Rebecca Robbins Relationships contributed by Seattle.